Special classes of income that are chargeable to tax under Section 4A of the. 12014 on Withholding Tax on Special Classes of Income on 23 January 2014.

In A Landmark Judgment Itat Orders Payment Of Tax On Rs 196 Crore Stashed Abroad Job Ads India Breaking News How To Find Out

Sections 1101a 1101c 1105e 11311 1139 Regulations.

. Payer refers to an individualbody other than individual carrying on a business in Malaysia. Information in this ruling may be relied upon by taxpayers as the basis for determining their tax liability. Your W-2 Wage and Tax Statement itemizes your total annual wages and the amount of taxes withheld from your paycheck.

W-2 Wage and Tax Statement Explained. TSB-M-031S Sales Tax on Rent for Hotel Occupancy and the Exception for Permanent Residents TSB-M-1010S Amendments. The W-2 form is a United States federal wage and tax statement that an employer must give to each employee and also send to the Social Security Administration SSA every year.

Individual Taxation The Inland Revenue Board of Malaysia issued Public Ruling No. 12014 Withholding Tax on Special Classes of Income. 112018 Withholding Tax on Special Classes of Income PR 112018 The Inland Revenue Board of Malaysia IRBM has uploaded on its website the PR 112018 issued on 5 December 2018 which supersedes the previous Public Ruling No.

042017 The objective of this ruling is to explain-. Make a copy of your previously filed POA. Withholding tax is an amount withheld by the party making payment payer on income earned by a non-resident payee and paid to the Inland Revenue Board of Malaysia.

It sets out the interpretation of the Director General of Inland Revenue in respect of the particular tax law and the policy and procedure that are to be applied. Write Revoked across the top of the copy. 102019 Withholding Tax on Special Classes of Income Introduction The Inland Revenue Board of Malaysia IRBM has recently released PR No.

Effective date 14 DIRECTOR GENERALS PUBLIC RULING A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is. The total payment that includes salary fee per diem accommodation and medical allowance in total 13800 is subject to witholding of tax at the rate of 10. The purpose of this ruling is to explain how income is determined to compute income under section 8 of the Income Tax Act from the business of construction contracts and property development.

Sign and date the top of the revoked copy. Employee or independent contractor for the purposes of wage withholding tax. Public Ruling PR No.

The Inland Revenue Board IRB of Malaysia issued Public Ruling PR No. 102019 Withholding Tax on Special Classes of Income dated 10 December 2019 to explain the. Publication 848 A Guide to Sales Tax for Hotel and Motel Operators Memoranda.

References and other useful information. 12014 on Withholding Tax on Special Classes of Income on 23 January 2014. Relying on this Ruling This is a public ruling within the meaning of Article 113 of the Income Tax Law 2005.

A ruling is issued for the purpose of providing guidance for the public and officers of the Inland Revenue Board of Malaysia. The annual performance bonus will also be subjected to witholding of tax as this is actually additional payment paid in connection to services rendered by the non-resident. New Public Ruling on Withholding Tax Special classes of income The Inland Revenue Board of Malaysia IRBM issued Public Ruling No.

Send a revoked copy of the previously filed POA to the Tax Department. You may click here for the said Public Ruling. Tax on Special Classes of Income Public Ruling No.

To view an example of a properly revoked Form POA-1 see Example. Gains or profit received from offshore companies 14 14. 12014 last amended on 27 June 2018.

INCOME TAX PUBLIC RULING FOR WITHOLDING OF TAX PR NO. 112018 on 5 December 2018 which supersedes the previous guidance on nonresident withholding tax on special classes of income PR No. Documents required 13 - 14 13.

Payment of withholding tax 12 - 13 12.

Tax Cases Monthly Round Up June 2022

Pin On Paid Vs Unpaid Internships

Consequences Under Food Safety Norms For Not Having Fssai License Food Safety Financial Firm Financial Institutions

Monthly Digest Of Tax Cases May 2022

Authority For Advance Ruling Under Income Tax

25 Key Income Tax Case Laws Of The Year 2021 Taxmann Com

Advance Ruling Power To Grant Exemption From Tax Cgst Act 2017

Reassessment Dispute Case Sc Rules In Favour Of Revenue Department Business Standard News

Southampton East Hampton In Different Positions After Irs Ruling On Septic Grants 27 East

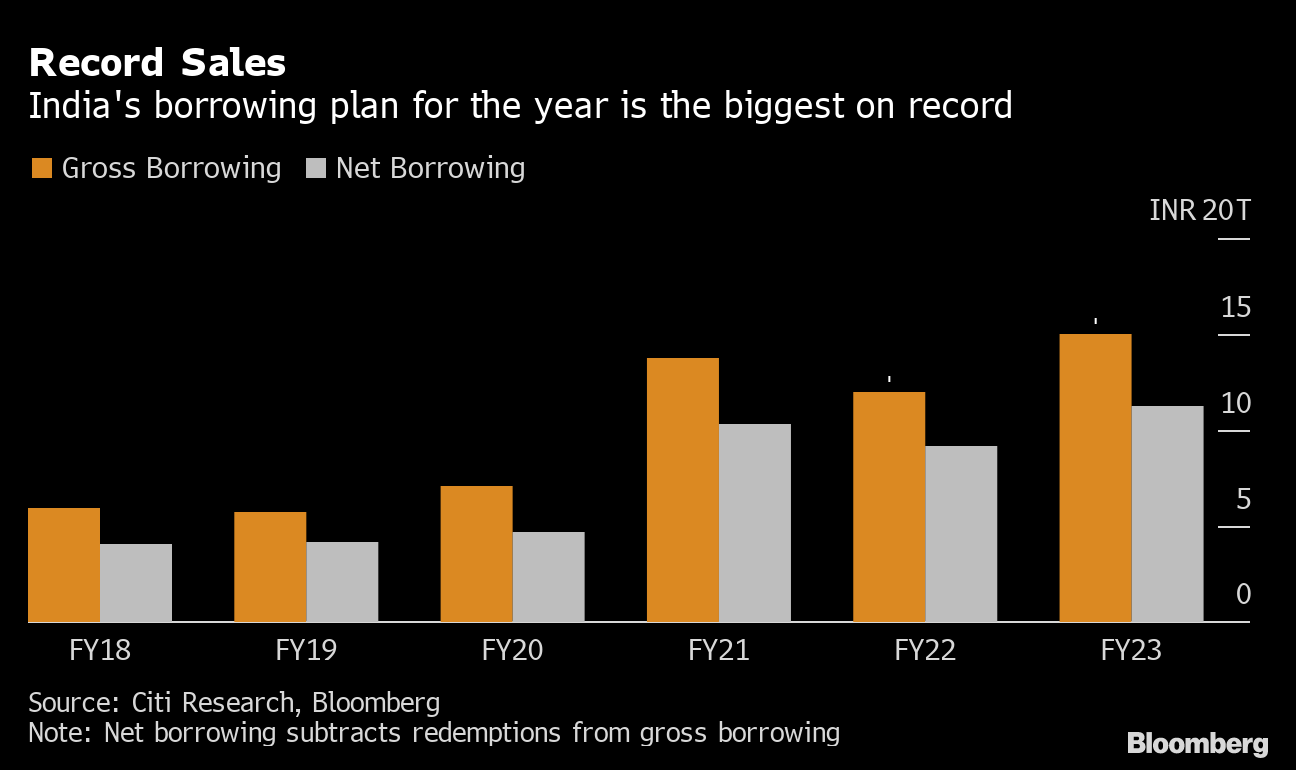

India Gst Tax Ruling Emboldens States Against Modi S Government Bloomberg